Revised MM2H Guidelines: A Comprehensive Guide

The Malaysia My Second Home (MM2H) program has long been a beacon for expatriates looking to enjoy a better quality of life in Malaysia. Whether you’re attracted to Malaysia’s beautiful landscapes, rich culture, or affordable cost of living, the MM2H program offers a viable pathway to make Malaysia your second home. However, recent changes to the program have introduced a range of new eligibility requirements and conditions that potential applicants need to be aware of. Let’s explore these revised guidelines and understand what they mean for you.

Key Takeaways

- Eligibility: Applicants must be at least 25 years old, or 21 in special financial zones.

- Financial Commitment: Significant fixed deposits are required, varying by category.

- Property Investment: Participants must invest in property in Malaysia, with restrictions on resale.

- Stay Requirements: A minimum stay of 90 days per year is mandatory.

- Health and Education: Dependents can pursue education and participants can receive long-term medical treatment in Malaysia.

General Requirements for MM2H

The revised MM2H program is open to foreign nationals from countries that have diplomatic relations with Malaysia. This is a significant consideration as it means that applicants must come from countries that maintain friendly relations with Malaysia. The minimum age for applicants is set at 25 years, which is a change aimed at attracting more mature and financially stable individuals.

Another important requirement is that applications must be made through licensed MM2H tourism operators. This ensures that the application process is handled professionally and that all necessary documentation and procedures are followed correctly. Individual or walk-in applications are no longer accepted, which streamlines the process and reduces the risk of incomplete or incorrect submissions.

All applications, whether new or for renewal, must be submitted through the MM2H One Stop Centre. This centralized processing point handles all immigration and approval matters, which are under the jurisdiction of the Ministry of Home Affairs and the Immigration Department of Malaysia. Even appeals for rejected applications must be directed to the Minister of Home Affairs.

Category-Based Requirements: Platinum, Gold, and Silver

The MM2H program now categorizes applicants into three distinct categories: Platinum, Gold, and Silver. Each category has specific financial requirements, participation fees, and other conditions that applicants must meet.

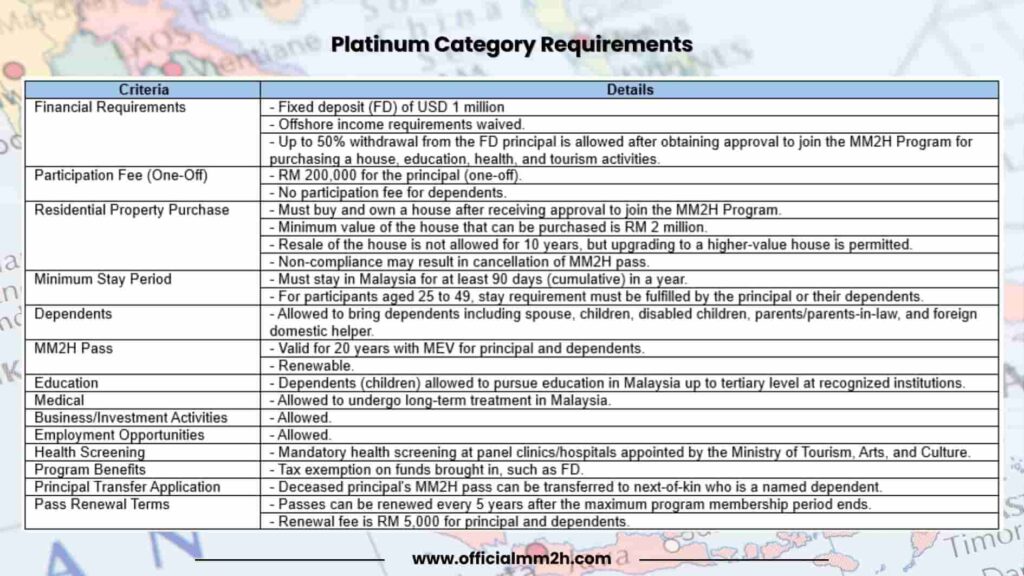

Platinum Category

Financial Requirements:

- Fixed Deposit: Applicants in the Platinum category are required to place a fixed deposit of USD 1 million in a financial institution licensed under the Financial Services Act 2013 or the Islamic Financial Services Act 2013.

- Offshore Income: Offshore income requirements have been waived for all categories, including Platinum.

- Withdrawal: Up to 50% of the fixed deposit principal can be withdrawn after obtaining approval to join the MM2H program. This withdrawal is permitted for purposes such as purchasing a house, education, health, and tourism activities in Malaysia.

Participation Fee:

- The participation fee for the principal applicant is RM 200,000 (one-off), and there is no participation fee for dependents.

Residential Property Purchase:

- Participants are required to buy and own a house after receiving approval to join the MM2H program.

- The minimum value of the house that can be purchased is at least RM 2 million.

- Resale of the house is not allowed for 10 years, although upgrading to a higher-value house is permitted. Failure to comply with these conditions may result in the cancellation of the MM2H pass.

Minimum Stay Period:

- Participants must stay in Malaysia for at least 90 days (cumulative) per year. For those aged 25 to 49, this stay requirement can be fulfilled either by the principal or their dependents.

Dependents:

- Participants are allowed to bring their dependents, which include spouses, biological/step/adopted children under 21 years old, children aged 21 to 34 who are not working or married in Malaysia, disabled children of any age certified by a medical specialist, parents, parents-in-law, and foreign domestic helpers.

MM2H Pass:

- The MM2H pass is valid for 20 years with Multiple Entry Visa (MEV) for the principal and dependents. The pass is renewable.

- The validity period of the security sticker is based on the approved MM2H pass validity period, subject to the passport validity period. If the passport expires before the MM2H pass, participants must renew the security sticker.

Other Benefits:

- Dependents can pursue education in Malaysia up to the tertiary level at recognized institutions. They can use the existing MM2H pass or be granted a Student Pass automatically.

- Participants are allowed to undergo long-term medical treatment in Malaysia.

- Business and investment activities are permitted, as are employment opportunities.

- A mandatory health screening must be conducted at panel clinics/hospitals appointed by the Ministry of Tourism, Arts, and Culture for both the principal and dependents after receiving approval to join the MM2H program.

- Tax exemption is provided on funds brought in as fixed deposits.

- If the principal applicant passes away, the MM2H pass can be transferred to the next-of-kin who is a named dependent.

- Passes can be renewed every 5 years after the maximum program membership period ends, with updated documents including a valid passport copy, medical report, and health insurance.

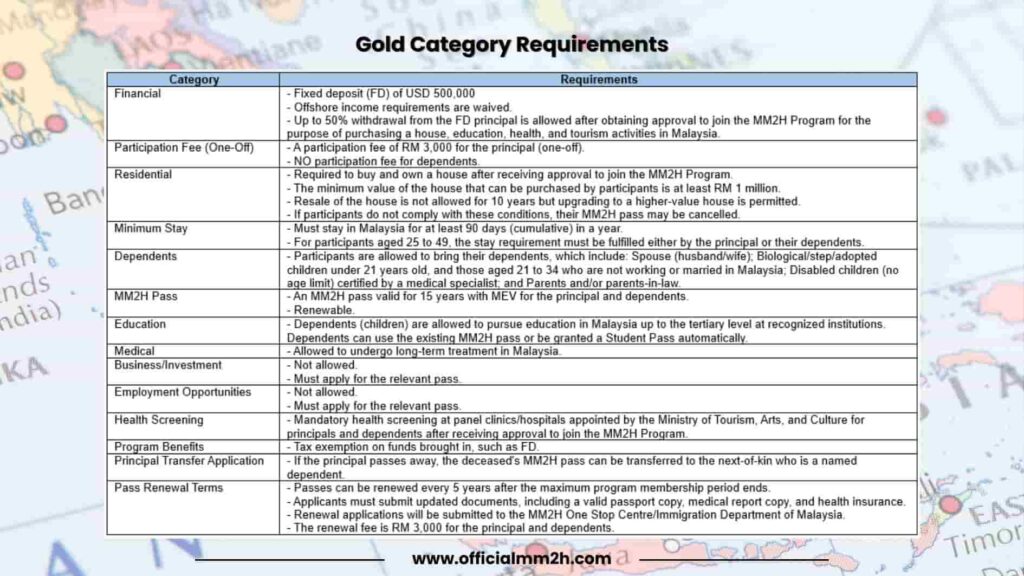

Gold Category

Financial Requirements:

- Fixed Deposit: USD 500,000

- Offshore Income: Waived

- Withdrawal: Up to 50% for house purchase, education, health, and tourism activities in Malaysia

Participation Fee:

- Principal: RM 3,000 (one-off)

- Dependents: None

Residential Property Purchase:

- Minimum Value: RM 1 million

- Resale Restriction: 10 years

Minimum Stay Period:

- 90 days per year (cumulative)

Dependents:

- Similar to Platinum, including spouses, children under 21, children aged 21-34, disabled children, and parents/parents-in-law.

MM2H Pass:

- Valid for 15 years, renewable

Education and Medical:

- Dependents can pursue education up to tertiary level

- Long-term medical treatment allowed

Business and Employment:

- Not allowed without relevant pass

Health Screening:

- Mandatory at designated panel clinics/hospitals

Program Benefits:

- Tax exemption on funds brought in as fixed deposits

Principal Transfer:

- MM2H pass transferable to next-of-kin upon the principal’s death

Pass Renewal:

- Every 5 years with updated documents and renewal fee of RM 3,000

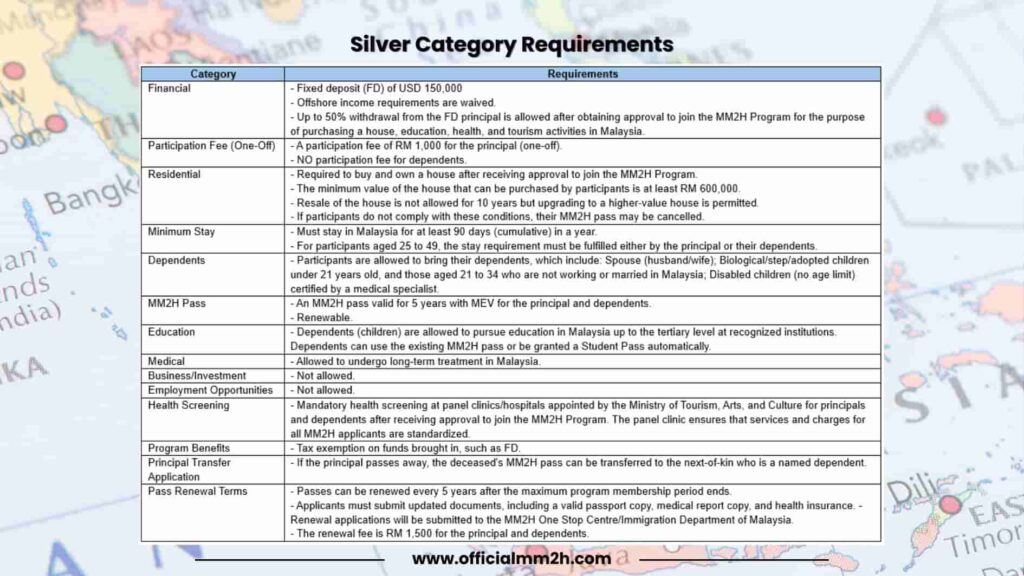

Silver Category

Financial Requirements:

- Fixed Deposit: USD 150,000

- Offshore Income: Waived

- Withdrawal: Up to 50% for house purchase, education, health, and tourism activities in Malaysia

Participation Fee:

- Principal: RM 1,000 (one-off)

- Dependents: None

Residential Property Purchase:

- Minimum Value: RM 600,000

- Resale Restriction: 10 years

Minimum Stay Period:

- 90 days per year (cumulative)

Dependents:

- Spouses, children under 21, children aged 21-34, and disabled children

MM2H Pass:

- Valid for 5 years, renewable

Education and Medical:

- Dependents can pursue education up to tertiary level

- Long-term medical treatment allowed

Business and Employment:

- Not allowed without relevant pass

Health Screening:

- Mandatory at designated panel clinics/hospitals

Program Benefits:

- Tax exemption on funds brought in as fixed deposits

Principal Transfer:

- MM2H pass transferable to next-of-kin upon the principal’s death

Pass Renewal:

- Every 5 years with updated documents and renewal fee of RM 1,500

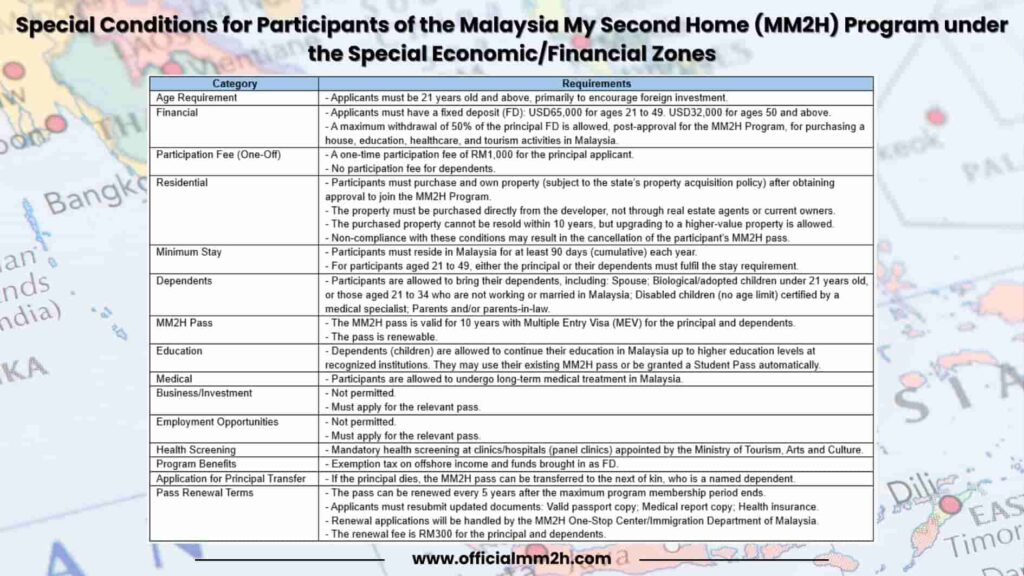

Special Conditions for Special Financial Zones

In addition to the general categories, the MM2H program has introduced special conditions for participants in Special Financial Zones. These zones aim to attract younger investors and professionals.

Age Requirement:

- Applicants must be at least 21 years old.

Financial Requirements:

- Fixed Deposit:

- Ages 21-49: USD 65,000

- Ages 50 and above: USD 32,000

Participation Fee:

- Principal: RM 1,000 (one-off)

- Dependents: None

Residential Property Purchase:

- Must purchase property directly from the developer

- Resale Restriction: 10 years

Minimum Stay Period:

- 90 days per year (cumulative)

Dependents:

- Similar to other categories, including spouses, children under 21, children aged 21-34, and disabled children.

MM2H Pass:

- Valid for 10 years, renewable

Education and Medical:

- Dependents can pursue education up to tertiary level

- Long-term medical treatment allowed

Business and Employment:

- Not allowed without relevant pass

Health Screening:

- Mandatory at designated panel clinics/hospitals

Program Benefits:

- Tax exemption on funds brought in as fixed deposits

Principal Transfer:

- MM2H pass transferable to next-of-kin upon the principal’s death

Pass Renewal:

- Every 5 years with updated documents and renewal fee of RM 300

Here’s an updated document on the new eligibility requirements for participating in the Malaysia My Second Home (MM2H) program (Malay Version), as revised by MOTAC on July 22, 2024.

Here’s an updated document on Special Conditions for Participants of the Malaysia My Second Home (MM2H) Program under the Special Economic/Financial Zones (Malay Version), as revised by MOTAC on July 22, 2024.

Summary Table

To make things easier, here’s a summary of the key points in a table format:

| Category | Fixed Deposit | Participation Fee | Property Value | Pass Validity | Employment | Business Activities | Health Screening | Minimum Stay Period |

|---|---|---|---|---|---|---|---|---|

| Platinum | USD 1 million | RM 200,000 | RM 2 million | 20 years | Allowed | Allowed | Mandatory | 90 days/year |

| Gold | USD 500,000 | RM 3,000 | RM 1 million | 15 years | Not allowed | Not allowed | Mandatory | 90 days/year |

| Silver | USD 150,000 | RM 1,000 | RM 600,000 | 5 years | Not allowed | Not allowed | Mandatory | 90 days/year |

| Special Zones | USD 32,000-65,000 | RM 1,000 | Varies | 10 years | Not allowed | Not allowed | Mandatory | 90 days/year |

In conclusion, the revised MM2H guidelines introduce more structured and tiered participation categories, each with specific financial and residency requirements. These changes aim to attract serious long-term residents and investors, while also ensuring a more organized and beneficial program for both the participants and Malaysia. Whether you are considering the Platinum, Gold, or Silver category, or looking into the special conditions for Special Financial Zones, it’s essential to understand these requirements to make an informed decision. The new guidelines reflect Malaysia’s commitment to fostering a welcoming and sustainable environment for expatriates while ensuring that the benefits of the program are maximized for all involved.

If I look at all the category, I think the special zones category seems more attractive. The fixed deposit is so little as compared to the silver category. The pass validity is also better than silver.

I agree that the special economic and financial zones category within the MM2H program does indeed seem attractive. The requirements for this category are more accessible, especially considering the financial deposit amounts, which are significantly lower than those in the Silver category. For instance, the financial deposit required for participants in the special zones is only USD 65,000 for applicants aged 21 to 49 and USD 32,000 for those aged 50 and above. This is in contrast to the Silver category, which requires a fixed deposit of USD 150,000.

Additionally, the validity of the MM2H pass in these special zones is comparable to or even more favorable than some of the more general categories. The MM2H pass for the special zones has provisions that might be more beneficial in terms of ease of meeting the financial obligations and longer-term residency benefits, enhancing its attractiveness as an option for potential participants looking for both affordability and extended stay benefits in Malaysia.

Hello,

For the Silver level it can be any property, correct? Not just from developer but also secondary market?–as long as it meets the price minimum.

Yes! For the Silver category, you are permitted to purchase properties from both the primary and secondary markets. This means you can opt for existing, “second-hand” properties instead of limiting yourself to new developments directly from developers.

You are also allowed to utilize up to 50% of your fixed deposit immediately without any waiting period. Upon receiving your MM2H visa, you have a 12-month window to finalize your property purchase. Ensure that you complete all necessary steps, including signing the contract and paying the deposit, within this timeframe. It is recommended to begin your property search early to avoid last-minute pressures and ensure you secure the desired property efficiently. All documentation related to the property purchase must be submitted to the Ministry of Tourism, Arts and Culture (MOTAC) through your agent within 12 months.

Hello

Would it be possible to share links of some licensed MM2H tourism operators.

Thnx

You can find a comprehensive list on the Ministry of Tourism, Arts and Culture website for more licensed operators and their contact details at https://motac.gov.my/semakan/mm2h. However, currently, you can’t submit a new application for the MM2H program. The process has been halted until further notice. Agents are still gathering essential information and documents, but they cannot submit applications until the government gives the official go-ahead. In fact, many agents are busy renewing their own licenses at the moment.

Special Zones Visa:

– Somewhere I read that the 90 days minimum stay must be in the Special Zone. Is that correct?

– If not, can the property that has been compulsorily purchased be rented out, or are ghost towns with empty properties being “artificially” created by the state?

Thank you for your questions regarding the Special Zones Visa! Yes, you are correct that the 90-day minimum stay requirement typically applies within the Special Zone. Regarding the properties that have been compulsorily purchased, they usually cannot be rented out. This policy is intended to prevent the creation of ghost towns and ensure that the areas remain vibrant and populated. It’s always best to consult the latest official guidelines or reach out to an MM2H agent for the most accurate information. If you have any more questions, feel free to ask!

I would like to know about the Gold pass if it enjoys the welfare and buying property/car just like any Malaysian, except we can’t work in the land? Do MM2H need to pay for any foreign tax to buy the property/car? If MM2H need to pay extra tax to buy the new property, what is the tax rate we need to bear if compare to any Malaysian or foreigner? We must buy a new property after approval of MM2H? or any pre-owned property before we become MM2H also can? Thanks

Thank you for your questions about the Gold Pass under the MM2H program! Gold Pass holders do enjoy similar benefits as Malaysians when it comes to purchasing property and cars, but you are correct that you cannot work in Malaysia without a separate work permit.

Regarding taxes, MM2H holders typically do not have to pay additional foreign taxes specifically for property or car purchases, but you may be subject to property taxes or stamp duties just like any other buyer. The tax rates can vary based on the property price and state regulations, so it’s important to consult with a local expert for precise figures.

You are also allowed to purchase either new or pre-owned property after receiving your MM2H approval, so there’s flexibility in your options. If you have more questions or need additional details, feel free to ask!

Hello,

Is purchasing a property mandatory under the SEZ program, and if so, at what amount?

Hello! Yes, purchasing a property is mandatory under the SEZ program, but the specific amount required is still being clarified. Typically, there are minimum price thresholds set by the state government, but these can vary.

Hello, How to justify offshore income of 10,000 MYR / Month in sarawak Program?

Hello! To justify an offshore income of RM 10,000 (for couple) per month for the Sarawak MM2H program, you’ll need to provide a copy of your employment confirmation, along with your latest six months of payslips and bank statements as proof of your monthly offshore income funds. This documentation should clearly demonstrate your earnings. If you have any more questions or need further assistance, feel free to ask!

– How to apply for Special Zones category, is it open or not yet?

– Is the only cash for it is 65,000 to 32,000 USD? or there is requirement to purchase a property beside that?

– Can I apply from outside Malaysia?

– Is Dependent Study schools allowed after approval of visa?

– Can you provide some approved agents for the application?

Hello!

1. The Special Zones category is currently on hold, and we are awaiting an official announcement on when applications will open.

2. For the Special Zones category, financial requirements vary by age: USD 65,000 for ages 21-49 and USD 32,000 for ages 50 and above. However, there is typically a requirement to purchase property at a minimum value set by the state, so it’s advisable to prepare for that as well.

3. You can certainly apply from outside Malaysia. Once the application process resumes, it will likely be accessible to international applicants.

4. Yes, dependents can attend schools in Malaysia after visa approval, and this includes primary, secondary, and possibly tertiary education, subject to institution policies.

5. As for agents, it’s essential to ensure any agent you consider is officially licensed. You can find a list of approved agents on the official Immigration Department of Malaysia’s website or the Ministry of Tourism, Arts and Culture website (However, currently, you can’t submit a new application for the MM2H program. The process has been halted until further notice. Agents are still gathering essential information and documents, but they cannot submit applications until the government gives the official go-ahead. In fact, many agents are busy renewing their own licenses at the moment.)

Feel free to ask if you have more questions!

Hello, I had a question regarding the Gold Tier MM2H visa. Would someone with a Gold Tier visa be able to hire an Overseas Domestic Helper from an agency in Malaysia? Thank you very much.

Hello! For someone holding a Gold Tier MM2H visa, hiring an Overseas Domestic Helper through a Malaysian agency is generally permissible. However, it’s important to comply with the specific requirements and regulations set by the immigration department regarding hiring foreign domestic workers. It’s advisable to consult directly with an agency or legal advisor to ensure all conditions are met and to guide you through the process. Thank you for reaching out, and feel free to ask if you have more questions!

Hi and thank you for assistance. Do you have a timeline of when the MM2H program will be accepting applications again? Also if the silver plan only gives you a 5 year visa how come we can’t sell the property for 10 years (does that mean you are guaranteed that they will accept your application renewal after the initial 5 years)? Finally, can children attend university and if so are they considered local or international students?

Hi! You’re welcome, happy to help. Currently, the MM2H program is still not accepting new applications, and we are awaiting an official announcement from the government for reopening dates.

Regarding the Silver Plan, while it offers a 5-year renewable visa, the requirement to hold onto the property for at least 10 years is meant to promote long-term investment. While renewal is generally expected for compliant participants, it’s not guaranteed, so it’s important to meet all eligibility criteria.

As for education, children under the MM2H program can attend universities in Malaysia as international students, which may impact tuition rates and admission procedures. It’s best to check directly with the universities for their specific policies.

Feel free to ask if you have more questions!

Hi I got some questions regarding the new MM2H:

1. Which property falls under special economic zone in Johor and at what is minimum property price requirement?

2. I saw in the news that there is agency fee of 40.000 MYR required which also includes medical insurance. Does it include the premium for the duration of the visa? Otherwise, what is it for?

1. Property in the Special Economic Zone in Johor

In Johor’s Special Economic Zone (SEZ), which includes Iskandar Malaysia, properties must meet certain criteria. Applicants under the MM2H SEZ program need to purchase residential property directly from a developer, with a resale restriction of 10 years. The property must adhere to the local authority’s minimum price threshold, which typically is quite high, often around RM 500,000 to RM 1,000,000 depending on specific areas and current government regulations .

2. Agency Fee Details

The mention of an RM 40,000 agency fee might relate to comprehensive service packages offered by MM2H facilitation agents. These packages often include:

Application Processing: The handling of all administrative tasks related to the application.

Medical Insurance: Initial arrangement for medical insurance as required by the MM2H program. However, the coverage specifics, such as whether it includes premiums for the entire visa duration, should be clarified with the agent. Typically, ongoing insurance premiums might be the responsibility of the visa holder.

It’s important to get a detailed breakdown of what is included in any quoted fee from the agency to ensure that all aspects, like medical insurance coverage, are clear. It’s advisable to directly verify these details with a licensed MM2H agent or official Ministry of Tourism, Arts, and Culture for the most accurate and complete information

Hi Ava, can you tell me if the employment prohibition applies to online work outside Malaysia as well, or only work within Malaysia?

Thanks!

Hi! The employment prohibition under the MM2H program mainly focuses on preventing participants from engaging in work within Malaysia. Online work that is conducted for clients or companies outside Malaysia is generally not restricted under the MM2H regulations. However, it’s always best to consult the relevant authorities or a legal expert to ensure full compliance with current regulations.

Hello, will you please clarify for me that the property could be sold within ten years if you no longer wished to remain on the MM2H program.

Also, if the property is an apartment in a major and busy tourist area (in a special economic zone) would renting it for part of the year be allowed while the MM2H participant was overseas?

Thank you for your assistance.

1. There is no specific source in the MM2H guidelines stating that the property can be sold within ten years if you no longer wish to remain in the program. It does mention that selling the residence is not allowed for ten years. However, upgrading to a residence of higher value from the current property is permitted. It’s advisable to consult with a local real estate expert or legal advisor to ensure you understand any procedures or implications involved.

2. If the property is in a special economic zone and a major tourist area, renting it out while you are overseas might be possible. However, rental regulations can vary, so it’s important to review the terms of the Malaysia My Second Home (MM2H) program and local laws. It’s advisable to consult with a property management professional or legal advisor in Malaysia to ensure compliance with any specific regulations or restrictions.

Hello,

Greetings from Canada;

I learned that there are significant changes in the requirements for MM2H.

For instance, the silver tier requires an FD of RM700,000 is this true?

If so, could you update your information please?

Regards,

Andrew

Greetings from Malaysia! Thank you for your message and for highlighting the recent changes to the Malaysia My Second Home (MM2H) program.

As per the latest guidelines, the Silver category requires applicants to place a fixed deposit of USD 150,000 (approximately RM 700,000) in a Malaysian financial institution licensed under the Financial Services Act 2013 or the Islamic Financial Services Act 2013. This fixed deposit serves as proof of financial stability and commitment to residing in Malaysia.

Additionally, participants in the Silver category are required to purchase and own a residence in Malaysia valued at a minimum of RM 600,000. The property cannot be sold for 10 years, although upgrading to a higher-value property is permitted. There is also a minimum stay requirement of 90 cumulative days per year.

We have updated our information to reflect these changes. If you have any further questions or need assistance with the MM2H application process, please feel free to reach out.

Best regards,

Ava

Hi Ava – can you advise what the Fixed Deposit requirement would be upon renewal of a Silver MM2H membership in 5 years? I understand that 50% of the initial Silver USD 150,000 fixed deposit can be utilised to purchase a property. That would leave a minimum amount of USD 75,000 in the fixed deposit for 5 years. Upon renewal of the MM2H would this fixed deposit amount need to be increased or left at USD 75,000 as I would have already purchased a property.

Thanks for your help.

Thank you for your question regarding the Fixed Deposit (FD) requirements for the renewal of a Silver MM2H membership.

You’re correct that under the Silver MM2H program, participants may utilize 50% of the initial USD 150,000 FD (USD 75,000) for the purchase of a property in Malaysia. This leaves a minimum balance of USD 75,000 in the FD account, which must be maintained for the first five years.

For renewal after the initial five-year period, the FD requirement typically remains the same, provided you meet all other program criteria and conditions. This means that the remaining USD 75,000 should suffice for renewal, assuming the property purchase has been completed and all program conditions are satisfied. There is generally no requirement to replenish the original USD 150,000 FD amount upon renewal.

However, as program rules and policies can evolve, I recommend verifying this with the MM2H authorities or an authorized agent closer to your renewal date to ensure compliance with the latest guidelines.

I hope this helps clarify your query!

Best regards,

Ava

Hi!

For MM2H SEZ visa – can I purchase condo from the developer FIRST, followed by visa application? If affirmative, is there a deadline between property purchase and visa application?

Thank you in advance.

Thank you for your inquiry regarding the MM2H Special Economic Zone (SEZ) visa.

Under the MM2H SEZ program, applicants are required to purchase residential property directly from a developer as part of the visa application process. This property purchase is a mandatory component of the program and must adhere to the local authority’s minimum price threshold, which typically ranges between RM 500,000 and RM 1,000,000, depending on the area and current government policies.

Regarding the sequence of actions, it is generally acceptable to purchase the condominium from the developer first and then proceed with the visa application. However, it’s crucial to ensure that the property meets all the criteria set by the MM2H SEZ program and that the purchase aligns with the program’s requirements.

As for the timeframe between the property purchase and the visa application, the official guidelines do not specify a strict deadline. Nonetheless, it is advisable to initiate the visa application promptly after the property purchase to ensure that all documents are current and to facilitate a smoother application process.

Please be aware that policies and requirements can change, so it’s essential to verify the latest information before making any commitments. Consulting with a licensed MM2H agent or the relevant authorities can provide personalized guidance tailored to your situation.

I hope this information assists you.

Best regards,

Ava

Hello. Thank you for your kind clarification.

Can I buy two properties to meet the RM600,000 requirement for the Silver category? For example, let’s say I buy one property for RM 310,000 and another property for RM 300,000. Total RM 610,000. I will live in the first property for 6 months/year and the second property for 6 months/year.

Is this feasible?

Thank you for your assistance.

Thank you for your inquiry regarding the property purchase requirements for the Silver category of the Malaysia My Second Home (MM2H) program.

According to the latest MM2H guidelines, the property purchase requirement must be fulfilled with a single residential property valued at a minimum of RM600,000. Combining the value of two separate properties to meet this threshold is not permissible under the current program rules.

Therefore, purchasing one property for RM310,000 and another for RM300,000, even though their combined value is RM610,000, would not satisfy the MM2H Silver category’s property purchase requirement.

I hope this clarifies your query. If you have any further questions or need additional assistance, please feel free to ask.

Best regards,

Ava