Owning Property in Malaysia vs Renting: What Should Expats Choose in 2025?

Deciding whether to rent or buy property in Malaysia as an expatriate in 2025 is a critical choice with long-term implications. This decision involves financial considerations, legal obligations, and personal lifestyle preferences. With Malaysia’s property market evolving rapidly, it’s essential to understand the pros and cons of buying versus renting to make the best decision.

Malaysia’s Real Estate Market: A Snapshot

Malaysia’s real estate market has shown consistent growth. By 2029, it is projected to grow from $36.76 billion to $50.69 billion, demonstrating the potential for property value increases. This growth is largely fueled by urbanization and rising demand for residential properties. For expats, the property market represents both opportunities and challenges.

Rental properties in Malaysia have also become more competitive. With average monthly rental payments reaching RM1,995 in 2024, the trend of rising rental prices is expected to continue in urban areas like Kuala Lumpur. Market conditions have made it vital for expats to weigh the costs of buying versus renting before making a decision.

Financial Considerations: The Costs of Buying vs. Renting a Property

Buying Property in Malaysia: A Long-Term Investment

For those planning to stay in Malaysia long-term, owning a property can be a worthwhile investment. The property market’s growth means property value increases are likely, making home purchases a smart option for building wealth. However, buying involves significant upfront costs:

- Stamp Duties and Legal Fees: These costs are part of the initial expense of buying a house in Malaysia.

- Maintenance Costs: As a homeowner, you must take into account the expenses to maintain or renovate the property.

- Mortgage Payments: Fixed monthly payments may make budgeting predictable, but they also tie you to the property.

Owning a property allows you to benefit from capital appreciation and rental income if you decide to rent out the property. However, it also involves long-term commitment, making flexibility limited.

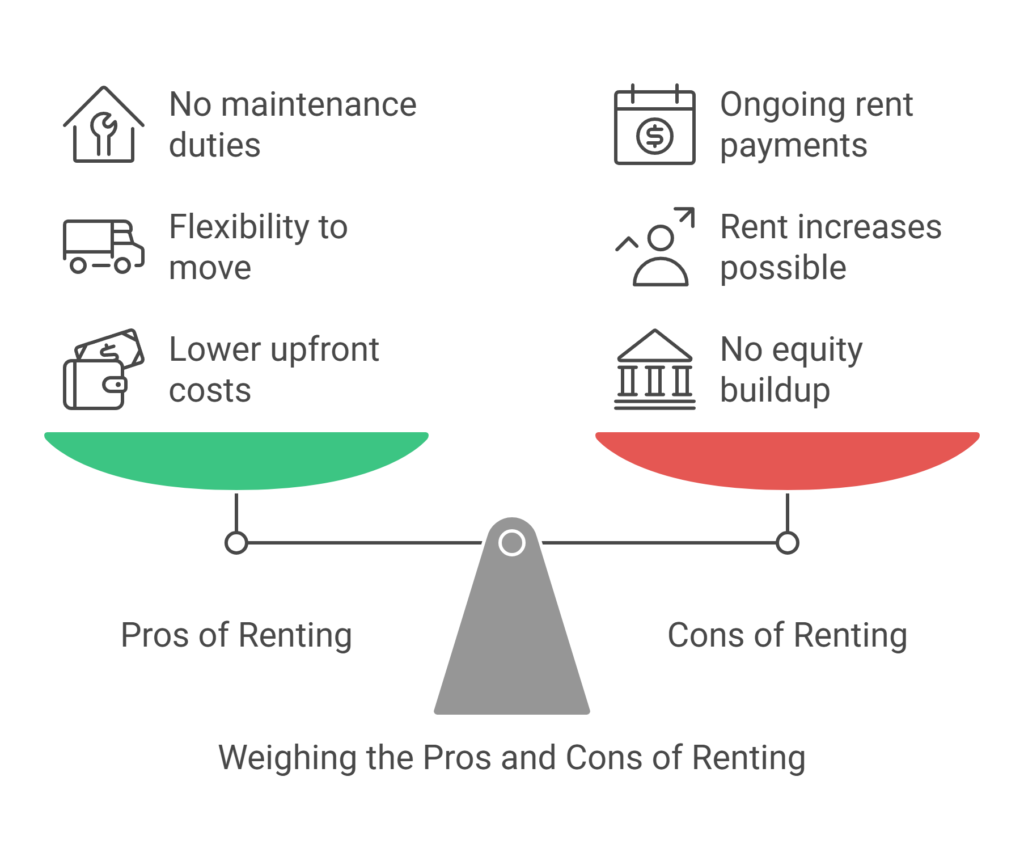

Renting Property: Flexibility Without Commitment

For expats with shorter stays or uncertain plans, renting a property in Malaysia offers greater flexibility. Renting avoids the upfront costs of buying a property and eliminates maintenance costs. However, rental payments do not contribute to building equity, and rent increases can affect your budget over time.

Renting offers flexibility and allows you to stay in one place temporarily while exploring the market conditions or deciding whether buying might be a better option. However, renting may be less advantageous for those who can afford to buy a house and plan to live in Malaysia for the long term.

Legal Considerations: Regulations for Foreign Property Buyers in Malaysia

Malaysia is among the most accessible countries for foreign property ownership, but expats must navigate specific regulations:

- Property Value Thresholds: Expats must purchase a property above a minimum price. For example, in Kuala Lumpur, the price of the property must be at least RM1 million.

- Restricted Properties: Foreigners cannot buy properties on Malay Reserved Land or low to medium-cost housing.

- Financing Challenges: Banks offer mortgages to foreign buyers, but the cost of buying can increase due to higher interest rates and stricter loan conditions.

Legal fees and real estate agent fees are additional costs to consider when purchasing a property in Malaysia. Expats should consult legal professionals to ensure compliance with state-specific property ownership regulations.

Lifestyle Considerations: Deciding Between Buying vs Renting a Property

Owning a Home: A Stable Option for Long-Term Expats

For expats committed to staying in Malaysia, buying a house provides stability. Home ownership allows you to integrate into local communities and offers long-term investment potential through property appreciation. Buying a property in Malaysia is also a way to build equity and avoid the fluctuations of rental payments.

Renting Offers Flexibility for Short-Term Stays

Renting a house is ideal for expats who prioritize flexibility. Monthly rental payments allow you to live in prime locations without the long-term commitment of buying. Renting may also be a better option for those who prefer to avoid the responsibilities of property ownership.

The flexibility of renting allows you to adapt to changing circumstances, such as job relocations. However, the limited control over the property and rising rental rates are factors renters should consider.

Pros and Cons of Buying and Renting a Property in Malaysia

Pros of Buying a Property

- Long-term investment potential through property appreciation.

- Stability and equity-building opportunities.

- Ability to renovate and personalize the property.

Cons of Buying a Property

- High upfront costs, including legal fees and stamp duties.

- Maintenance costs and mortgage payments.

- Limited flexibility if market conditions require you to sell the property.

Pros of Renting a Property

- Lower upfront costs compared to buying.

- Flexibility to move or switch rental properties.

- Avoids maintenance responsibilities.

Cons of Renting a Property

- Rent payments do not contribute to equity.

- Rent increases can affect your monthly budget.

- Limited control over the property and lease terms.

Key Questions When Deciding Between Buying and Renting

When deciding whether to rent or buy, take into account these important factors:

- What’s Your Financial Situation?

Can you afford the upfront costs of buying a property, or do monthly rent payments fit better into your budget? - How Long Do You Plan to Stay?

If you plan to stay in Malaysia for several years, buying your own house may be the better option. - What Are Your Lifestyle Preferences?

Do you prefer the stability of owning a home or the flexibility of renting? - Have You Considered the Legal and Financial Aspects?

Consult professionals to understand the costs and restrictions involved in property ownership.

Making the Right Decision: Owning Property in Malaysia vs Renting?

The decision to buy or rent a property in Malaysia as an expat in 2025 depends on your financial situation, lifestyle, and long-term plans. Both options come with their advantages and disadvantages, so carefully evaluate your needs before making a choice.

For expats seeking long-term investment and stability, buying might be the ideal choice. However, renting offers the flexibility needed for short-term stays or uncertain circumstances.

Conclusion: Seek Expert Guidance

Navigating Malaysia’s property market can be challenging, but the right resources and advice can make all the difference. Whether you’re looking to buy or rent, consult real estate professionals and legal advisors to make an informed decision.