MM2H Controversy: Is the Malaysia My Second Home Programme Favoring the Wealthy Too Much?

The Malaysia My Second Home (MM2H) program has long been a cornerstone of Malaysia’s strategy to attract foreign talent and retirees. This second home programme, once celebrated in Malaysia for its inclusivity and affordability, allowed expatriates to live in Malaysia and enjoy its cultural diversity, low cost of living, and strategic location. However, recent changes to the MM2H programme have raised concerns about whether the initiative is becoming overly exclusive, favoring the wealthy while sidelining middle-income expatriates.

In this article, we’ll explore the evolution of MM2H, the criticisms it has faced, comparisons with regional programs, and its implications for Malaysia’s reputation as a top expat destination.

The Evolution of the MM2H Programme

Federal MM2H

When first introduced, the Malaysia My Second Home programme was an attractive option for expatriates seeking long-term residency. With moderate financial requirements, it enabled retirees, families, and middle-income earners to relocate to Malaysia easily. However, a significant revamp of the MM2H programme has altered its accessibility.

The federal program now features a tiered structure, dividing applicants into three tiers—Silver, Gold, and Platinum. Each tier has escalating financial commitments:

- Fixed Deposits: Applicants must deposit between USD 150,000 and USD 1 million, depending on their chosen tier.

- Property Purchases: The minimum property purchase threshold starts at RM600,000.

- Participation Fees: Applicants pay higher fees depending on their tier, alongside meeting minimum residency requirements.

Sabah and Sarawak MM2H

In Sabah, a revised version of the MM2H programme—known as the Sabah-MM2H programme—has slightly lower thresholds compared to the federal scheme. However, the requirements are still significant for middle-income applicants. Sarawak, another state offering a regional version, has similarly raised its financial barriers, making it less accessible than before.

These changes, according to Minister Datuk Seri Tiong King Sing, aim to attract “high-quality” applicants. Still, many argue that they have made the program less inclusive and less competitive on the global stage.

Criticisms of the MM2H Programme

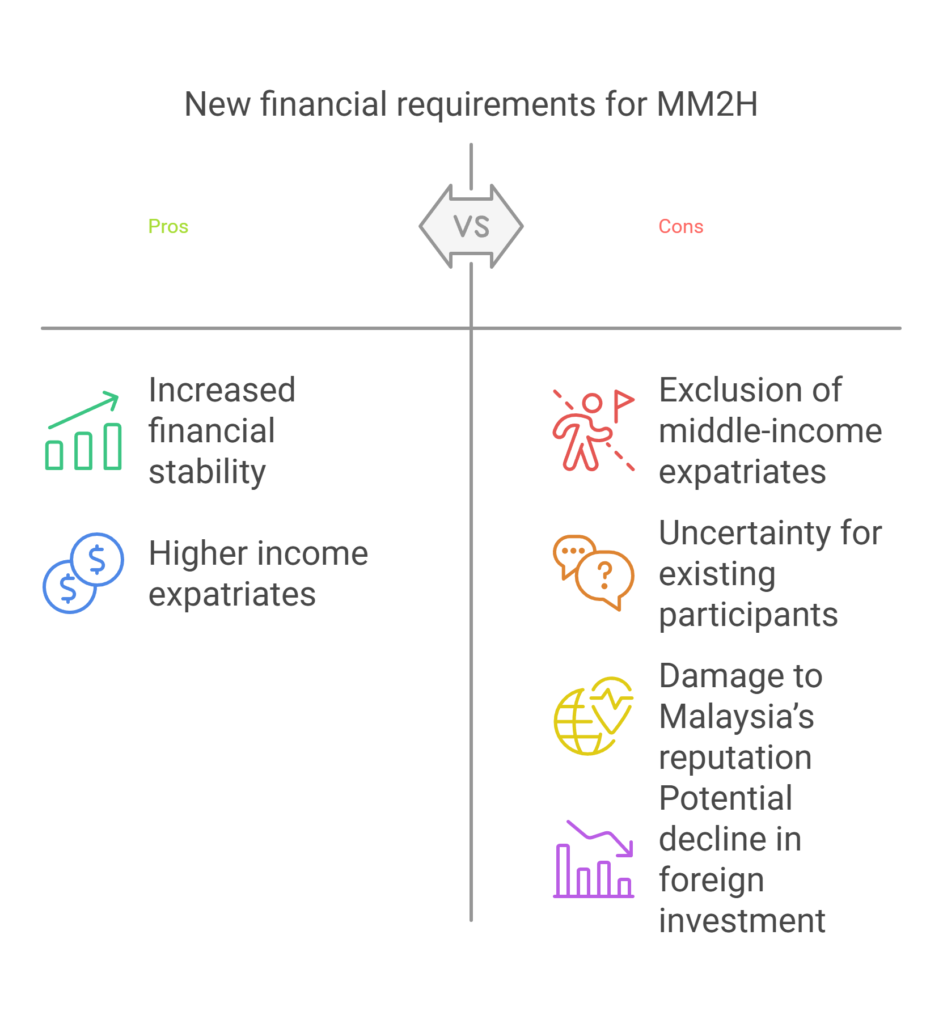

1. Exclusion of Middle-Income Expatriates

The increased financial requirements have priced out a significant segment of expatriates. Many retirees and families who previously found Malaysia appealing now see the program as unattainable.

2. Uncertainty for Existing Participants

Expatriates already living in Malaysia under the MM2H programme are facing uncertainty. The abrupt policy changes have left many unsure whether they can meet the stricter criteria for visa renewals.

3. Damage to Malaysia’s Reputation

According to Environment Minister Datuk Christina Liew, these changes risk alienating a broad base of potential applicants. The program’s exclusivity may harm Malaysia’s image as a welcoming and affordable destination. Critics, including stakeholders in tourism, real estate, and local businesses, argue that the new thresholds could deter foreign investment and spending.

MM2H Compared to Regional Competitors

Malaysia’s MM2H faces stiff competition from neighboring countries offering similar foreign residency processes. Let’s look at how it compares to programs in Thailand, Indonesia, and the Philippines.

Thailand’s Long-Term Resident Visa

Thailand’s LTR visa provides a more flexible option for expatriates, with lower financial requirements and benefits like tax incentives and fast-track services. The absence of a fixed deposit requirement makes it a popular choice among retirees and investors.

Indonesia’s Second Home Visa

Indonesia has launched its Second Home Programme, which appeals to retirees and entrepreneurs. With moderate financial thresholds and a focus on flexibility, it is an increasingly attractive alternative to MM2H.

Philippines’ Special Resident Retiree’s Visa (SRRV)

The SRRV program in the Philippines is celebrated for its minimal financial requirements and straightforward application process. It is particularly appealing to retirees who prioritize affordability and simplicity.

While the Malaysia My Second Home programme was once a leader in the region, it now struggles to compete due to its high financial barriers.

Decline in Applications and Economic Impacts

Since the revamp of the MM2H programme, applications have dropped sharply. The stricter requirements have dissuaded many potential applicants, raising concerns about the program’s viability.

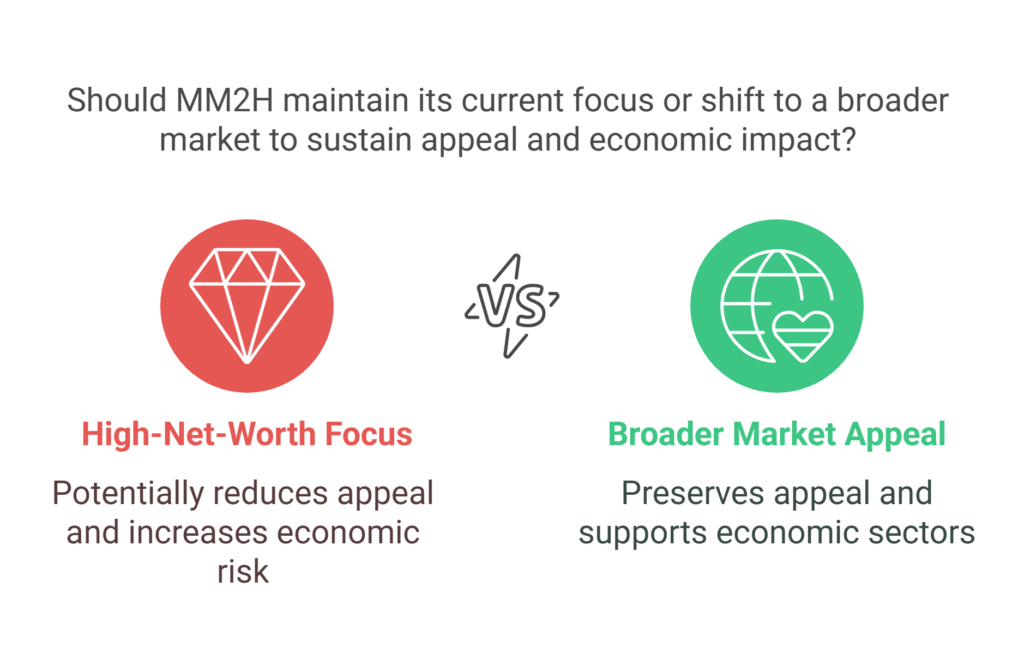

1. Loss of Appeal

Malaysia’s reputation as an affordable and accessible destination has been one of its greatest strengths. By focusing on high-net-worth individuals, MM2H may lose its appeal to the broader market of retirees and middle-income expatriates.

2. Economic Consequences

The decline in MM2H participation could negatively impact industries such as tourism, real estate, and local businesses. Reduced foreign spending might affect sectors that rely heavily on expatriates, particularly in cities like Kota Kinabalu.

3. Regional Competition

With neighboring countries like Thailand and Indonesia offering more competitive programs, Malaysia risks losing its edge in the regional expat market.

Government Perspective on MM2H Changes

The Ministry of Tourism, Arts, and Culture (MOTAC), under Minister Datuk Seri Tiong King Sing, defends the program’s revamp as a strategy to attract “high-value” expatriates who can contribute significantly to Malaysia’s economy.

According to a statement today, MOTAC aims to position Malaysia as a premium destination, targeting individuals who can meet the program’s elevated requirements. However, critics argue that this approach overlooks the value brought by middle-income expatriates, who often integrate well into local communities and stimulate economic growth.

Liew said that while attracting high-net-worth individuals is a valid goal, Malaysia must strike a balance to ensure the program remains inclusive and competitive.

Is MM2H Still Competitive?

The MM2H programme is at a critical crossroads. With applications declining and regional competitors gaining traction, Malaysia must address several key challenges:

- Reassess Financial Requirements: The current thresholds may need adjustment to attract a broader range of applicants.

- Build Trust: Addressing the concerns of existing participants and stakeholders is crucial for rebuilding confidence in the program.

- Promote Inclusivity: Restoring the program’s original vision of affordability and accessibility will help maintain its appeal.

Conclusion

The Malaysia My Second Home programme has been a vital tool in attracting expatriates to live in Malaysia, but recent changes have shifted its focus toward exclusivity. By prioritizing high-net-worth individuals, Malaysia risks alienating middle-income expatriates who have historically driven the program’s success.

While the government’s intent to create a premium image is clear, the changes have created challenges in maintaining MM2H’s competitiveness. Compared to neighboring programs in Thailand, Indonesia, and the Philippines, MM2H now faces significant hurdles in attracting potential applicants.

For Malaysia to reclaim its status as a top expat destination, policymakers must carefully navigate these challenges, ensuring the program appeals to a diverse audience while achieving its economic goals.