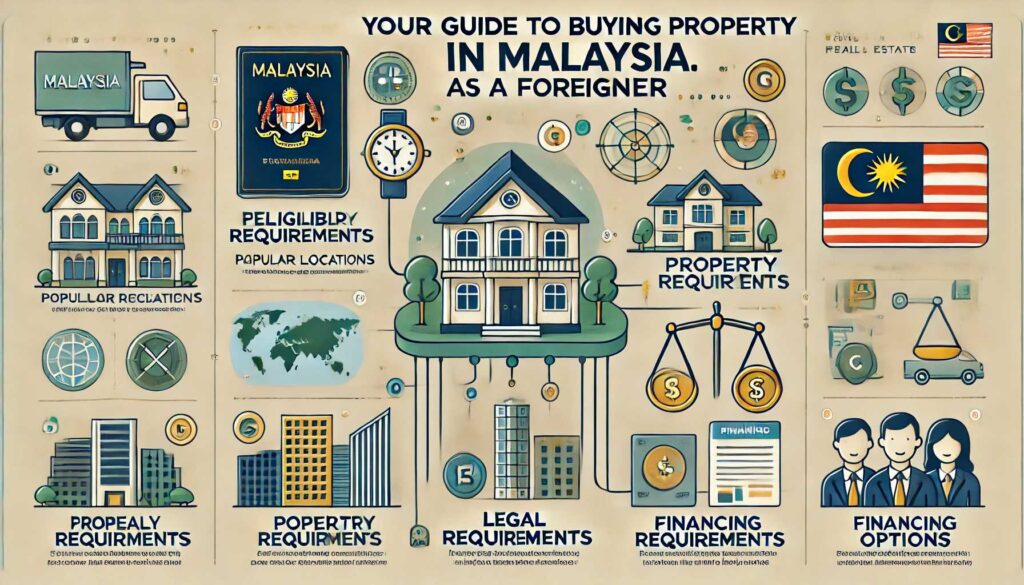

Your Guide to Buying Property in Malaysia as a Foreigner

As Malaysia continues to develop its economy and real estate markets, the country has become increasingly attractive to international buyers. With affordable living costs, diverse cultures, and accessible visa options, Malaysia offers significant opportunities for foreigners who want to invest, work, or retire here. Recent updates to the Malaysia My Second Home (MM2H) program and the introduction of Special Economic Zones (SEZ) and Special Financing Zones (SFZ) have made buying property in Malaysia easier and more beneficial for international investors.

In this guide, we’ll dive into the key aspects of foreign property ownership in Malaysia, covering financing options, the MM2H residency program, SEZ and SFZ incentives, and essential information about legal requirements and financing. Let’s explore how Malaysia is making property ownership for foreigners more accessible in 2024.

Can Foreigners Buy Property in Malaysia?

Yes, foreigners can legally buy property in Malaysia, but there are specific regulations in place. Here are the main categories of international buyers and some important financial requirements:

- Singaporean and Bruneian Buyers:

These buyers often receive more favorable financing options, with some Malaysian banks offering financing up to 90% with a maximum tenure of 30 years. This financing rate is similar to that available to Malaysian citizens, making it easier for Singaporeans and Bruneians to invest in Malaysia. - Foreigners from Other Countries:

Typically, foreigners from other countries can expect to make a down payment of 50% or more, as the available financing margin is generally between 50% and 70%. This group includes buyers from places like Canada, the U.S., Australia, and Europe. - Foreigners with Singapore Permanent Resident Status:

These individuals often have more flexibility if they live and work in Singapore but choose to purchase property in Malaysia due to the high property costs in Singapore. Like Singaporeans and Bruneians, they may qualify for higher financing and better loan tenures.

Minimum Property Value Requirements for Foreign Buyers

The Malaysian government has set minimum value requirements on property purchases for foreigners, which vary depending on the location of the property:

- Kuala Lumpur: Foreigners can purchase properties with a minimum value of RM 1 million.

- Selangor: Here, the minimum property purchase value is RM 2 million.

- Johor (Medini): The Medini area in Johor has no minimum property purchase requirement, which has made it a hotspot for foreign investment, especially for those wanting proximity to Singapore.

These minimum prices are generally based on the state laws and guidelines and are in place to help ensure that locals can still access affordable housing while allowing foreigners to invest in Malaysia’s growing property market.

The Malaysia My Second Home (MM2H) Program Updates

The MM2H program is a long-term residency program that offers qualifying foreigners an opportunity to live in Malaysia for extended periods. In 2024, the Malaysian government introduced a revised MM2H program with three tiers designed to meet different needs and financial capacities: Platinum, Gold, and Silver.

1. MM2H Platinum

This tier is ideal for foreigners who want to live long-term in Malaysia and may also want to conduct business locally. The minimum requirement is USD 1 million, which provides a 20-year residency validity (renewable every five years). The MM2H Platinum allows applicants to establish business ventures in Malaysia.

2. MM2H Gold

With a minimum requirement of USD 500,000, the Gold tier offers a 15-year residency validity, also renewable every five years. While it doesn’t include business privileges by default, some entrepreneurial activities may still be possible with special applications.

3. MM2H Silver

The most accessible option, MM2H Silver, requires a deposit of USD 150,000, offering a 5-year renewable residency. While it provides fewer privileges, Silver allows applicants to live comfortably in Malaysia and invest in property.

For each MM2H tier, applicants are allowed to withdraw 50% of the required deposit after approval to invest in Malaysian property, healthcare, or local tourism. This flexibility is a recent addition that encourages foreigners to contribute to the Malaysian economy.

Special Economic Zones (SEZ) and Special Financing Zones (SFZ) for Foreign Investors

Malaysia has introduced SEZ and SFZ programs to attract foreign investment, particularly in the southern region near Singapore. These zones are designed to draw high-net-worth individuals and provide tax incentives and special financing rates.

- SEZ (Special Economic Zone):

SEZ offers reduced financial requirements and flexible residency options. For individuals under 50, the minimum deposit requirement is USD 65,000, while those aged 50 and above only need USD 32,000. SEZ locations are still being finalized but are expected to cover strategic areas in Johor. - SFZ (Special Financing Zone):

SFZ is primarily centered around Forest City in Johor. This program offers personal tax incentives, with a flat rate of 15% for individuals working in the zone and 0% corporate tax for those establishing family wealth offices.

These zones encourage property ownership and support investment by requiring foreigners to buy property directly from developers rather than third-party sellers. By aligning property purchases with specific zones, Malaysia creates vibrant communities around SEZs and SFZs that support both foreign residents and the local economy.

Financing and Loan Options for Foreign Buyers

Financing options are available for foreign buyers in Malaysia, though conditions vary depending on the buyer’s nationality, employment status, and income sources:

- Employment Status: Banks may check your employment status, including whether your employment is permanent or on contract, as well as the currency of your salary.

- Loan Tenure and Margin: While Singaporean and Bruneian buyers can get up to 90% financing and 30-year loan tenures, other foreign buyers generally receive 50-70% financing with a shorter loan tenure.

- Required Documentation: Banks will ask for proof of income, credit reports, and employment verification as part of the loan application process. These requirements may vary by lender, so consulting with a qualified Malaysian property financing expert can be beneficial.

Additional Considerations for Foreign Buyers

- Residency Requirements:

The MM2H program requires residency renewals every five years, and foreigners must reside in Malaysia for at least 90 days each year to maintain their status. - Property Sales Restrictions:

Foreign MM2H property owners cannot sell their properties within the first 10 years. This ensures that property purchases remain stable and limits speculation in the Malaysian real estate market. - Educational and Healthcare Access:

MM2H residents are eligible for access to Malaysia’s healthcare and educational systems. This provides a significant benefit for retirees or families with young children looking to settle in Malaysia.

Final Thoughts

Malaysia’s updated MM2H program, along with the SEZ and SFZ initiatives, opens up new possibilities for foreigners interested in buying property and establishing long-term residency. With tax incentives, affordable living, and attractive financing options, Malaysia is an excellent choice for foreigners looking to invest, work, or retire in a stable and diverse region.