Understanding MM2H Service Charges: Federal, Sabah, and Sarawak Programs

Malaysia My Second Home (MM2H) is a popular residency program designed for foreign nationals looking to reside in Malaysia long-term. While MM2H provides an attractive pathway for expats, the structure of the program varies across different regions—Federal Malaysia, Sabah, and Sarawak. Each region has its own rules, fees, and requirements. This article explores the service charges imposed by agents for these programs, offering a detailed comparison to help you make an informed decision.

What is MM2H?

MM2H allows foreign nationals to reside in Malaysia with a 10-year renewable visa. The program is managed differently across regions, with Federal MM2H operating under a national framework, while Sabah and Sarawak have their own localized versions. These variations extend to service charges imposed by agents who facilitate applications.

Federal MM2H: Premium Fees for Exclusive Services

Federal MM2H participants are subject to the highest service charges among all MM2H programs. Here’s a breakdown of the fees:

- Platinum Tier: RM70,000

- Gold Tier: RM55,000

- Silver Tier: RM40,000

- Special Economic/Financial Zones: RM40,000

Additional Costs and Payment Terms:

Agents are allowed to collect a deposit of up to 20% of the total service charge upfront. The remaining balance must be paid only after the participant’s application is approved and official documentation is issued.

Bank Guarantee Requirements:

Federal MM2H agents must provide a bank guarantee of RM200,000, the highest among all MM2H programs. This safeguard ensures compensation for participants in the event of agent non-compliance.

Key Considerations:

- Federal MM2H offers tiered pricing to accommodate different participant categories.

- With the highest fees and stringent requirements, Federal MM2H is best suited for participants who value premium services and can meet the financial commitments.

Sabah-MM2H: Affordable and Transparent

Sabah-MM2H stands out for its affordability and straightforward structure. The service charge for participants is a flat RM15,000, making it the most budget-friendly option among the three programs.

Additional Costs and Payment Terms:

Similar to Federal MM2H, Sabah-MM2H agents can collect a 20% deposit upfront, with the remaining balance due after the application is approved.

Bank Guarantee Requirements:

Agents operating under Sabah-MM2H are required to provide a bank guarantee of RM50,000, significantly lower than the Federal program.

Focus on Regional Development:

Sabah-MM2H emphasizes local ownership and employment:

- At least 51% of company ownership and workforce must consist of Sabah-born citizens.

- The company’s name must include “Sabah-MM2H” during registration.

Key Considerations:

- The flat rate of RM15,000 makes this program ideal for cost-conscious participants.

- Sabah-MM2H aligns with regional goals by prioritizing local citizens in ownership and employment opportunities.

Sarawak-MM2H: Tailored for Individuals and Families

Sarawak-MM2H offers a unique pricing structure that caters to individuals and families. Service charges are as follows:

- Individual Applicants: RM12,000

- Dependent Fee: RM2,000 per dependent

Excluded Costs:

Unlike the Federal and Sabah programs, Sarawak-MM2H does not include third-party expenses like medical examinations, insurance, and immigration-related fees in its service charges. Participants are responsible for these additional costs.

Service Tax:

An 8% service tax may be applicable to the total service charge, depending on the situation.

Additional Costs and Payment Terms:

Similar to the other programs, a 20% deposit can be collected upfront, with the remaining balance payable upon successful approval.

Bank Guarantee Requirements:

Sarawak-MM2H agents are required to provide a bank guarantee of RM100,000, which is higher than Sabah but lower than the Federal program.

Focus on Local Engagement:

Sarawak-MM2H prioritizes local participation by requiring:

- At least 51% local ownership and workforce from Sarawak-born citizens.

- Company names to include “Sarawak-MM2H” during registration.

Key Considerations:

- Sarawak-MM2H is ideal for individuals and families, especially those with dependents, as it provides a clear breakdown of charges.

- The program emphasizes local development while maintaining moderate costs for participants.

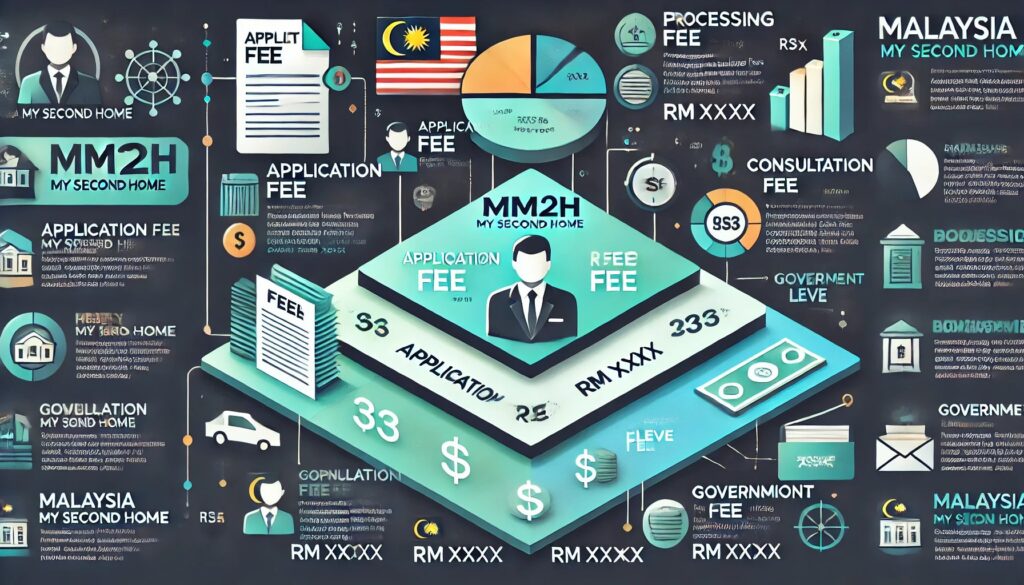

Key Differences Across MM2H Programs

To better understand the variations, here is a side-by-side comparison of the Federal, Sabah, and Sarawak MM2H programs:

| Category | Federal MM2H | Sabah-MM2H | Sarawak-MM2H |

|---|---|---|---|

| Service Charge | RM40,000–RM70,000 | RM15,000 | RM12,000 + RM2,000 (per dependent) |

| Bank Guarantee | RM200,000 | RM50,000 | RM100,000 |

| Deposit Allowed | 20% upfront | 20% upfront | 20% upfront |

| Regional Focus | National framework | Prioritizes Sabah-born citizens | Prioritizes Sarawak-born citizens |

| Third-Party Costs | May be included | May be included | Excluded (e.g., medical, insurance) |

| Service Tax | Not specified | Not specified | 8% may apply |

What’s the Best Option for You?

Choosing the right MM2H program depends on your financial situation, personal preferences, and intended location in Malaysia. Here’s a quick guide to help you decide:

- Federal MM2H:

- Ideal for those seeking premium services and access to the full range of benefits under a national framework.

- Best suited for participants with a higher budget who value flexibility in program categories.

- Sabah-MM2H:

- Perfect for cost-conscious individuals who prefer a straightforward, flat-rate structure.

- Best for participants who want to contribute to Sabah’s regional development.

- Sarawak-MM2H:

- Ideal for individuals and families, especially those with dependents, due to the clear pricing for additional family members.

- A good option for those who want moderate fees with a focus on local engagement.

Why Understanding Service Charges is Crucial

Service charges are a significant aspect of the MM2H program as they directly impact the overall cost of your application. Beyond the fees, the regional differences in focus—such as local ownership and employment requirements—can influence your decision based on your long-term goals in Malaysia.

Conclusion

The MM2H program offers diverse options to cater to different participant needs and regional priorities. Federal MM2H provides a premium experience at a higher cost, while Sabah-MM2H offers an affordable, flat-rate structure. Sarawak-MM2H, on the other hand, strikes a balance with low individual fees and additional dependent charges.

Choosing the right program depends on your preferences, budget, and intended residency region. Whether you’re an individual or a family, MM2H has a program tailored to your needs.